APAC Accelerates, EMEA Stabilizes: The Global PUD Market in Transition

- ial

- Jan 22

- 3 min read

Polyurethane Dispersions (PUDs) are water-based polyurethane solutions that provide low-VOC and eco-friendly performance for coatings, adhesives, sealants, and textile finishes. PUDs, which provide an effective combination of durability, flexibility, and regulatory compliance, are progressively replacing solvent-borne solutions.

As industries worldwide shift away from traditional solvent-based systems, both EMEA and Asia-Pacific regions see strong demand, though driven by different structural factors. APAC's rapid industrialisation and construction boom are accelerating the adoption of environmentally friendly dispersions, while EMEA's established regulatory frameworks promote sustainable product development and high-performance materials.

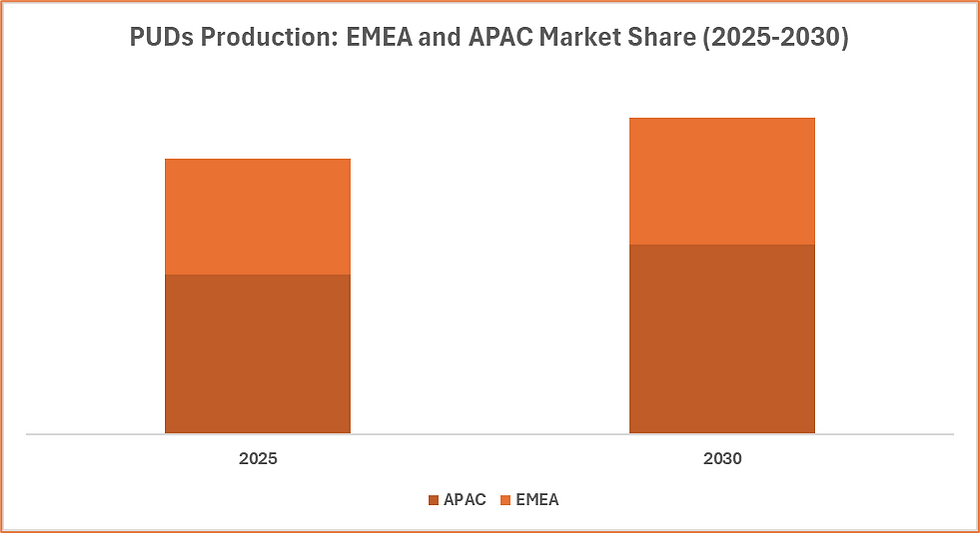

According to IAL Consultants, the Asia-Pacific region remained the largest market for Polyurethane Dispersions (PUDs) in 2025, led by China as the key producer. Furthermore, the region is predicted to register significant growth of 5% between 2025 and 2030. In contrast, the EMEA region's PUD production volume fell 4% in 2025 and is expected to grow at a modest CAGR of 2% through 2030.

The figure depicts the APAC and EMEA regions' respective production volume shares (in wet tonnes) in 2025, as well as the projected distribution for 2030

Key Regional Drivers and Sector Trends

Asia Pacific

The Asia-Pacific area remains a major global hub for PUD production. Despite a slight decrease at 1% in 2025, APAC retains significant production volumes and a faster projected growth trajectory than EMEA. The growth is being driven by the increasing use of high-performance, water-based solutions in coatings, adhesives, textiles, electronics, and packaging, as well as continual formulation advances that now allow Asian PUDs to compete with grades from Europe and North America. Furthermore, stricter regulations, environmental policies, and increasing consumer demand in China, Japan, and South Korea, combined with subsidies, VOC limits, and carbon-neutral targets, are accelerating the shift towards water-based polyurethane dispersions.

Unlike EMEA and the Americas, the largest end-use market in APAC is leather and textiles, followed by transport and plastic coatings. In recent years, the region has also witnessed an increase in the use of PUDs for niche applications.

While traditional sectors such as wood furniture, leather, textiles, and automotive refinish coatings continue to decline, growth is shifting to new energy vehicles, plastic coatings, electronics, and food packaging. China is a major contributor, benefiting from EV growth and environmental policies, despite ongoing cost pressures and economic instability. Regardless of its modest size India is emerging as a rapidly rising manufacturing and export base, particularly in the printing and packaging industries.

EMEA

In contrast, EMEA's output volume faced a more pronounced decline of 4% in production volume in 2025. The region anticipates a steady recovery beginning in 2026 as economic conditions improve and downstream demand stabilises. Western countries, such as Germany, Austria, Benelux, and Italy, experienced the sharpest fall in production due to decreased automotive activity and a slowdown in wood and furniture. Rising prices for MDI, polyols, and energy, combined with supply restrictions and plant closures, have lowered competitiveness. Stricter low-VOC standards, the phase-out of NMP/NEP, and ongoing research into alternative polyols, as well as water-based and UV-cured PUDs, continue to influence market development.

Among the end-use segments, transport coatings witnessed a significant stagnation and is further expected to show only moderate growth in the future. On the other hand, plastic coatings and general industrial applications are expected to grow the fastest. Fibre sizing, once thought to be the fastest expanding segment, has slowed significantly. However, the production of PUDs for food packaging, cosmetics, and other emerging end applications has expanded, and materials for these end markets will continue to acquire market share in the overall industry.

Outlook and Strategic Implications

The APAC region leads in PUDs production volumes and shows greater growth momentum, supported by substantial manufacturing activity and expanding industrial demand. Meanwhile, the EMEA market, though declining more rapidly, benefits from advanced formulation capabilities and regulatory alignment with sustainability goals. Across both regions, the transition to environmentally friendly waterborne PUD technologies remains a major trend, reflecting broader industrial shifts towards sustainability and performance optimisation.

Comments