Overview of the Global Polyurethane CASE Markets

- ial

- Nov 13, 2025

- 5 min read

Summary

The PU CASE (Coatings, Adhesives, Sealants, and Elastomers) segment, though often overshadowed by polyurethane foams, represents a vital and versatile part of polyurethane chemistry. These materials are integral to industries ranging from automotive and furniture to footwear, packaging, wind energy, and textiles. Their adaptability and superior performance make them essential for delivering tailored solutions that enhance durability, flexibility, adhesion, and sealing efficiency — underpinning innovation and functionality across modern manufacturing and design.

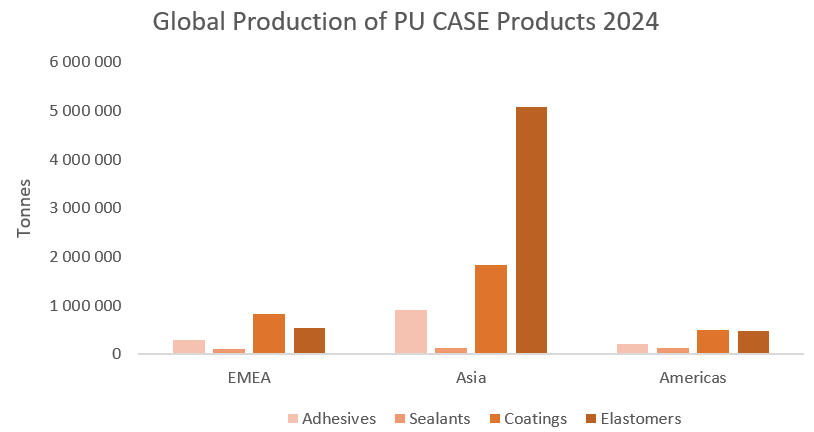

In 2024, global production of polyurethane (PU) CASE products reached around 11 million tonnes, with Asia maintaining its dominance. This strength is largely driven by the region’s robust PU elastomer industry, which contributes more than half of global production. Elastomers continue to represent the largest CASE segment, supported by steady demand from the automotive, construction, and consumer goods sectors.

The overall CASE market grew by about 2% in 2024, following a 1% increase in 2023, driven primarily by construction and automotive applications. Growth was underpinned by expanding infrastructure development across the Asia–Pacific, where rapid urbanisation and modernisation continue to propel both economic activity and material demand.

In 2024, PU elastomer production increased by more than 3%, while PU adhesives and sealants also maintained steady growth. However, PU coatings experienced a 1% decline, largely due to weakened construction activity, declining automotive sector and sluggish domestic demand.

The PU CASE market is led by Asia, holding around 70–75% of global share, driven by strong industrial growth and high demand from automotive, construction, and packaging sectors. EMEA follows with about 15–17%, supported by advanced manufacturing and a focus on sustainable formulations. The Americas account for roughly 10–13%, with demand concentrated in construction, transport, and flexible packaging. Asia remains the key growth hub, while EMEA and the Americas emphasise innovation and specialised applications.

In the automotive sector, rising vehicle production in China and India spurred demand for lightweight, energy-efficient PU adhesives and elastomers that enhance fuel efficiency and reduce environmental impact. Globally, manufacturers are shifting from petroleum-based to bio-based PUs to meet stricter sustainability standards, particularly in Europe. Electric vehicles further drive demand for advanced PU materials used in structural bonding and battery encapsulation.

In 2024, the North American construction sector continued to face challenges from high interest rates, inflation, and labour shortages. While housing activity remains subdued, easing material costs and strong federal investment in infrastructure and manufacturing are supporting growth, with U.S. industry output expected to rise by around 4.5% in 2024 and 4% in 2025. In contrast, Europe’s construction industry is in a mild downturn, with output across major markets projected to fall by about 2.4% amid high costs and weak demand. However, public funding for energy-efficient renovation and decarbonisation is providing some offset. For niche products such as polyurethane (PU) CASE, demand remains resilient supported by infrastructure and industrial projects in North America and sustainability-driven investment in energy-efficient construction across Europe.

Looking ahead to 2025, growth is expected to resume across all segments, with forecasts indicating recovery in elastomers (+3.6%) and coatings (+1.8%), alongside continued steady expansion in adhesives and sealants (+1.4%).

PU Coatings : Asia-Pacific Leads Amid Regulatory and VOC-Free Shifts

PU coatings are widely used across the automotive, construction, and wood sectors, with the automotive industry representing the strongest source of demand. Overall, coatings recorded a decline of around 0.95% in 2024. Construction coatings fell by approximately 0.5%, while the transport segment remained largely stagnant. The Asia–Pacific region dominates the global PU coatings market, accounting for around 58% of total demand, with China contributing roughly 73% of this share.

In Canada, the paints and coatings industries are facing increasing regulatory pressure as the government moves to phase out PFAS chemicals by 2025 and classify them as toxic under the Canadian Environmental Protection Act. Across Asia–Pacific, PU coatings are predominantly used in the wood, furniture, construction, marine, and automotive industries, with the wood and furniture segment representing about 32% of total production. The market is clearly shifting towards low- and zero-VOC formulations, driven by tightening environmental standards particularly in Japan aimed at fostering safer and more sustainable coating solutions.

PU Adhesives : Flexible Packaging Surge

PU adhesives saw strong growth in 2024, driven by demand from the automotive and flexible packaging sectors. The Asia–Pacific region dominated with over 60-65% market share, supported by rapid urbanisation and industrial growth in China and India. Footwear adhesives led in Southeast Asia and Oceania, while South Asia showed strong demand across footwear, automotive, and construction. Flexible packaging adhesives surged on the back of rising consumption of packaged food and medicines. In the Americas, construction adhesives remained the largest segment, though growth slowed; flexible packaging and transport applications showed the best momentum.

Within the PU CASE market, flexible packaging adhesives lead with 35-40% of total demand, driven by growth in food and consumer packaging and increasing focus on recyclable materials. Construction adhesives hold 20-25%, reflecting demand for durable, weather-resistant bonding in infrastructure and housing. Footwear adhesives represent 15-20%, valued for flexibility and strong adhesion in sports and safety footwear. Automotive adhesives account for 5-10%, targeting high-performance and lightweight vehicle applications. General assembly adhesives make up 5-10%, while the remaining 5-10% covers niche and emerging uses with strong innovation potential.

PU Sealants : Global Slowdown

In 2024, the PU sealant market exhibited contrasting performance across key sectors. The automotive glazing segment declined by around 1.5–2%, reflecting weaker global vehicle production. Similarly, the construction segment contracted by approximately 2–2.5%, constrained by macroeconomic pressures and geopolitical instability, particularly the ongoing Russia–Ukraine conflict. According to the European Automobile Manufacturers’ Association (ACEA), global light vehicle production reached about 75–76 million units in 2024, representing a marginal year-on-year decline of roughly 0.5%. These developments underline the PU sealant market’s sensitivity to industrial fluctuations and broader economic conditions.

PU sealants remain largely driven by construction and automotive applications. Construction sealants dominate with an estimated 50–55% share of total demand, supported by widespread use in building joints, façades, and infrastructure, where long-term durability and weather resistance are essential. Automotive direct glazing sealants account for around 25–30%, sustained by ongoing vehicle manufacturing and aftermarket glass replacement, valued for their strong adhesion, UV resistance, and vibration damping. Insulated glazing sealants hold roughly 10–15%, used primarily in double-glazed window systems for improved energy efficiency. The remaining 6–8% is attributed to other transport sealants, serving rail, marine, and aerospace applications where lightweight, flexible, and durable bonding is critical.

PU Elastomers

PU elastomers are highly versatile materials, serving as critical components across numerous industrial and consumer sectors. Their most prominent applications lie in synthetic leather and fibre (spandex) production, with Asia leading global output due to its strong textile and manufacturing base.

Synthetic leather elastomers dominate with an estimated 35–40% share of total demand, driven by expanding use in automotive interiors, furniture, and fashion, alongside a growing shift toward sustainable and high-performance alternatives to natural leather. Fibre and spandex elastomers follow with about 15–20%, supported by rising demand for stretchable fabrics in sportswear and performance apparel.

Thermoplastic polyurethane (TPU) elastomers account for roughly 15–20%, valued for their flexibility, abrasion resistance, and use in footwear, cables, and specialty films. Footwear elastomers, holding around 10–15%, benefit from steady growth in the global sports and lifestyle footwear market. Cast elastomers, representing about 5-10%, serve heavy-duty industrial applications such as rollers, wheels, and machinery components requiring superior wear resistance. The remaining 5–10% comprises other specialised elastomers, catering to niche industrial and consumer needs and offering potential for future innovation.

You can find the report in our shop:

For more information, please contact ial@brggroup.com

IAL Consultants (A Division of BRG Enterprise Solutions Ltd)

CP House, 97-107 Uxbridge Road, Ealing, London W5 5TL

Tel: +44 (0) 20 8832 7780

Comments