AN OVERVIEW OF THE GLOBAL MARKET FOR POLYOLS

- ial

- Jan 19

- 5 min read

IAL Consultants is pleased to announce the publication

of its reports on the Global Market for Polyols

This third edition of the four-volume report provides an in-depth and market-focused update on the global polyols industry, covering aliphatic polyester polyols, aromatic polyester polyols, polyether polyols and eco-friendly polyols. Building on the research published in 2023, this edition reflects the latest market developments, competitive dynamics and demand trends across all four polyol segments. All data in this edition have been extensively revised and updated through a comprehensive programme of primary and secondary research conducted during 2025.

The report presents data on the 2025 consumption of aliphatic and aromatic polyester polyols, as well as polyether and eco-friendly polyols, together with forecast consumption to 2030 (eco-friendly polyols forecast to 2035). Consumption data and forecasts are segmented by the three major geographic regions: the Americas, EMEA and Asia-Pacific.

Global Share of Consumption of Polyols for Polyurethanes, 2025-2030 (%)

Polyol Type | 2025 | 2030 |

Aliphatic Polyester Polyols | 20% | 19% |

Aromatic Polyester Polyols | 9% | 9% |

Standard Polyether Polyols | 60% | 59% |

PTMEG Polyols | 12% | 13% |

Total | 100% | 100% |

Global polyol consumption for polyurethanes between 2025 and 2030 remains strongly dominated by polyether polyols. Standard polyether polyols continue to account for the majority of demand, holding 60% of global consumption in 2025 and declining only marginally to 59% by 2030, confirming their central role across most polyurethane applications. PTMEG polyols gain modest share, increasing from 12% to 13%, driven by growth in high-performance elastomers and specialty end uses.

Polyester polyols collectively account for just under one third of global consumption. Aliphatic polyester polyols see a slight decline in share from 20% to 19%, while aromatic polyester polyols remain stable at 9%, supported by continued demand in rigid foam and construction applications. Overall, the consumption mix remains largely stable, with only incremental shifts reflecting evolving performance requirements rather than structural change in the market

Aliphatic Polyester Polyols

Polyester polyols continue to face strong competition from polyether polyols across many polyurethane applications, driven by cost, processing flexibility and raw material dynamics. Aliphatic polyester polyols are produced using adipic acid and glycols such as 1,4-butanediol or 1,6-hexanediol, making adipic acid availability a critical factor in their production. Adipic acid demand is dominated by nylon 6,6, which consumes around 85–90% of global output, linking aliphatic polyester polyol supply closely to trends in the automotive and textile sectors.

Following a shift from shortages to structural oversupply during 2023–2025, adipic acid markets remain volatile despite improved availability. Within this context, global consumption of aliphatic polyester polyols is forecast rise to 2.47 million tonnes in 2030, equivalent to a CAGR of approximately 4.5%.

This growth is driven primarily by strong demand in the Asia-Pacific (APAC) region, which dominates global consumption throughout the period. APAC consumption is forecast to increase significantly to nearly 1.8 million tonnes by 2030, corresponding to a CAGR of 5.1%. Rapid industrialisation, expansion of the polyurethane downstream industries, and continued growth in construction, automotive and appliance manufacturing are key factors underpinning this regional performance.

Aromatic Polyester Polyols

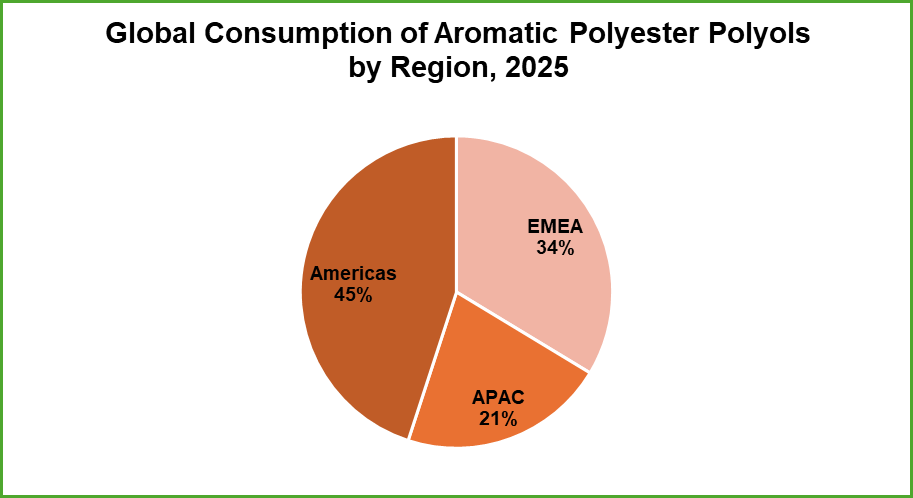

In 2025, global consumption of aromatic polyester polyols in polyurethane applications amounted to approximately 873,500 tonnes. Demand is forecast to grow steadily to around 1.10 million tonnes by 2030, representing an average annual growth rate of 4.6%. Growth is primarily driven by expanding insulation demand, infrastructure development and rising use of rigid polyurethane systems, particularly in energy-efficient construction and industrial applications. Regional growth patterns vary significantly, reflecting differences in construction activity, regulatory frameworks and industrial maturity.

North America represented the largest consuming market in 2025. Overall, the Americas accounted for around 45% of global demand for aromatic polyester polyol, driven primarily by strong uptake in construction insulation, particularly spray polyurethane foam (SPF) and PIR slabstock (boardstock) systems. Demand in the region is closely linked to the construction sector’s emphasis on improving building energy efficiency, alongside the gradual substitution of traditional insulation materials such as fibreglass. The Americas are also expected to record the strongest growth among mature markets over the forecast period.

The EMEA region ranked as the second-largest market, representing approximately 34% of global consumption of aromatic polyester polyol. Western Europe accounted for the majority of regional demand, supported by refurbishment activity, tightening energy-efficiency regulations and continued use of rigid insulation systems. In parallel, growth in the Middle East is being driven by infrastructure development and increasing adoption of high-performance insulation solutions.

Asia-Pacific, led by China, accounted for around 21% of global demand. Consumption in the region is supported by ongoing urbanisation, industrial construction and the expansion of cold-chain and refrigeration infrastructure; while the strict fire regulation in China hinders growth, it represents an increasingly important growth market over the longer term.

Polyether Polyols

Global consumption of standard polyether polyols reached approximately 6.0 million tonnes in 2025. Flexible foam applications dominated demand, accounting for about 53% of total consumption, followed by rigid foam (22.5%) and adhesives and sealants (10%).

The standard polyether polyols market is forecast to grow at a CAGR of 4.2% between 2025 and 2030. Asia-Pacific is expected to drive growth at a CAGR of 5.1%, while the Americas and EMEA are each projected to grow at 3.3%. By application, flexible foam is anticipated to be the fastest-growing segment, at a CAGR of 4.5%.

The European polyether polyols market continues to face pressure from weak demand, excess production capacity and rising imports, primarily from Asian suppliers.

Propylene oxide is the primary feedstock for polyether polyols, with ethylene oxide as the secondary feedstock. Polyol prices typically track propylene and crude oil trends, usually with a lag of one to two months.

Approximately 70% of global propylene oxide production is used in polyether polyol manufacturing. Global PO capacity expanded sharply, with additions peaking in 2024 at over 12 million tonnes per year; this was more than double the pre-pandemic average, largely driven by new capacity in Asia, particularly China. Planned and actual plant closures in 2025 may moderate this expansion.

In EMEA and the Americas, close to 60% of polyether polyols are consumed in flexible foam applications, followed by rigid foam at around 20%. Within the CASE market, adhesives and sealants represent the largest segments, while polyester polyols are more commonly used in polyurethane coatings, particularly water-based systems.

Eco-Friendly Polyols

Eco-friendly polyols are produced using manufacturing pathways designed to minimise carbon emissions, reduce resource depletion, and enhance end-of-life recyclability of polyurethane products. These polyols can be derived through a range of routes, including bio-based feedstocks, chemical recycling of polyurethane waste, recycled plastics such as PET, mass balance approaches, and alternative chemical processes. While certain technologies, most notably mass balance and recycled PET-based polyols, are already commercialised at scale, others remain in the research or pilot phase, reflecting varying levels of technological maturity.

Currently, eco-friendly polyols are primarily used in flexible polyurethane foams for furniture, bedding and automotive seating, where comfort, durability and resilience are critical. Their application is expanding steadily into rigid foam systems, particularly for thermal insulation in construction and refrigeration, driven by tightening energy-efficiency standards and green building regulations. In parallel, these polyols are increasingly being evaluated for CASE applications coatings, adhesives, sealants and elastomers, highlighting their growing versatility across the polyurethane value chain.

Global Overview of the Polyols Market is now available from IAL Consultants, priced at €10,500 for the complete four-volume report. Volumes are also priced individually. Click Here to buy the report.

For more information please contact:

IAL Consultants

CP House, 97107 Uxbridge Road

Ealing, London W5 5TL

Telephone: +44 (0) 20 8832 7780

Email: ial@brggroup.com

Or visit our website: www.ialconsultants.com

Comments