Global Overview of Sustainability in the Polyurethane Market 2025

- ial

- Jul 29, 2025

- 4 min read

Updated: Oct 9, 2025

IAL Consultants is pleased to announce the recent publication of its report on sustainability in the global polyurethane market.

The first edition of this study offers a comprehensive overview of the sustainable production landscape for polyurethane raw materials and products on a global and regional scale. It provides an in-depth examination of environmentally conscious manufacturing practices concerning key raw materials - primarily isocyanates and polyols - as well as a broad range of polyurethane-based products, including rigid and flexible foams, elastomers, thermoplastic polyurethanes (TPU), and others. The report encompasses detailed production figures and methodologies for both fossil-based and eco-based polyurethane raw materials and products, offering a dual perspective at both global and regional levels. The study also delivers an extensive analysis of polyurethane waste management practices, focusing on region-specific approaches and strategies. This includes a breakdown of post-production and post-consumer waste handling, with a clear emphasis on current trends and emerging technologies. The base year for all data is 2024, and the report provides five-year market projections through to 2029, alongside a forward-looking spot forecast for the year 2034.

Summary

The polyurethane industry is witnessing a swift shift towards sustainability, driven by regulatory mandates, corporate ESG obligations, and rapid technological progress. The producers across the value chain are incorporating environmentally responsible practices, such as adopting green raw materials, improving recycling methodologies, and striving to minimise carbon emissions throughout the entire lifecycle of polyurethane related materials. The incorporation first starts from the raw materials segment. It was in general observed that eco-friendly polyols are easier to obtain and incorporate into the polyurethane product lifecycle than eco-friendly isocyanates, and thus they showcase significant growth in comparison. In 2024, the market share of eco-friendly isocyanates was almost negligible with just 1% of the total isocyanate production. Meanwhile, eco-friendly polyols held a share of 2% of the total production. In comparison, the growth rate of eco-friendly polyols is much higher than that of eco-friendly isocyanates. It was observed that in both the segments, the mass balance technique occupies a major market share, with 94% of the total production of eco-friendly isocyanates and 42% of total production of eco-friendly polyols.

The report also covers the global and regional sustainability scenario of polyurethane products, namely rigid foam, flexible foam, elastomers, TPU, and coatings, binders, adhesives and sealants (CBAS). The yearly waste generated by these segments, except CBAS, and their management methods are also elaborately discussed.

Raw Materials

In 2024, global production of eco-friendly isocyanates remained limited, representing a minor portion of total isocyanate output. This low adoption is attributed to technological challenges, high production costs, and the continued dominance of conventional fossil-based methods. However, the sector is poised for substantial expansion, with volumes projected to rise sharply at a compound annual growth rate (CAGR) of 34%. This anticipated growth highlights both increasing industrial interest and the progression of alternative production technologies, aligning with broader sustainability goals in the polyurethane value chain, including reducing carbon emissions, advancing circularity, and decreasing reliance on fossil resources. Currently, mass balance-based isocyanates dominate the eco-friendly segment with a 94% market share, primarily due to their compatibility with existing production infrastructure. However, the market is expected to diversify as innovations such as sugar- and lignin-derived isocyanates and non-isocyanate polyurethanes (NIPUs) gain traction. Although still in the early stages, these alternatives promise enhanced environmental performance. By 2034, eco-friendly isocyanates are forecast to comprise around 13% of total global isocyanate production, marking a notable shift in industry practices.

Eco-friendly polyols, produced via environmentally conscious methods, are gaining traction due to their reduced environmental footprint. These polyols, derived through various commercial and experimental routes, are primarily used in flexible foam applications for furniture, automotive seating, and bedding, thanks to their superior cushioning properties. However, their use is expanding into rigid foam markets—particularly for insulation in buildings and refrigeration—driven by energy efficiency demands. Additionally, they are gradually entering the CASE (coatings, adhesives, sealants and elastomers) segments. Global production numbers, in 2024, represented just 2% of the overall polyol market, yet rapid growth is anticipated. By 2034, market share is expected to surge to 34%, reflecting an impressive CAGR of 37%.

Polyurethane Products

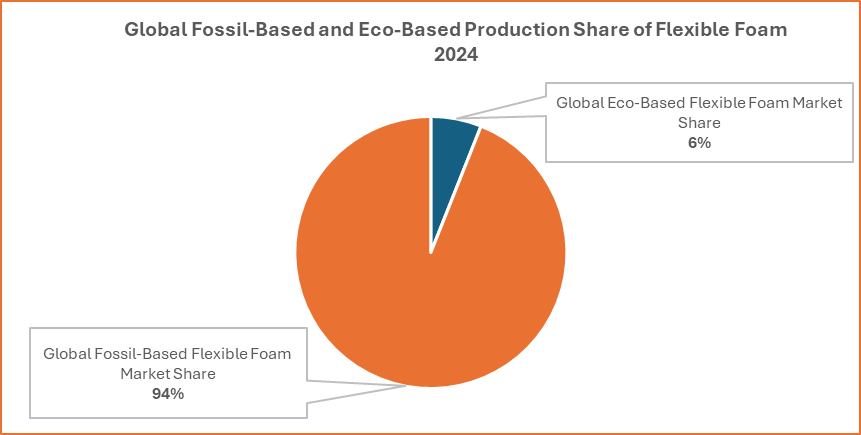

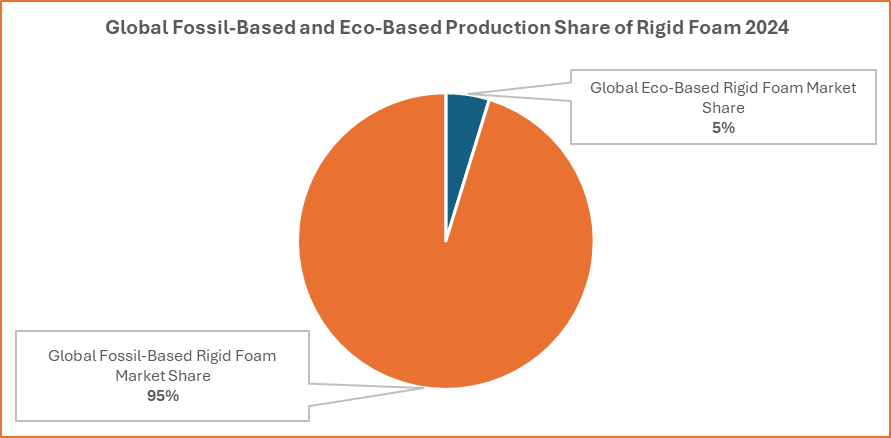

In 2024, the global production of eco-based flexible foam accounted for around 6% of total market share. This is projected to soar to a substantial 60.5% share with an expected CAGR of 31%. Similarly, eco-based rigid foam production, estimated at 304,500 tonnes in 2024 (4.7% market share), is expected to expand to 5 million tonnes by 2034, reaching a market share of 53% with a CAGR of 32%, driven by downstream demand and regulatory support.

The market share of eco-based elastomers in 2024 stood near 1.6% and is further forecasted to grow dramatically to 3.1 million tonnes by 2034, achieving a 42% share and a CAGR of 44%. This transition is driven by increasing environmental pressures, strict emission and waste regulations, and rising consumer preference for sustainable materials. Industries such as automotive, footwear, electronics, and healthcare are incorporating renewable and recycled feedstocks to lower fossil dependency and emissions.

Eco-based thermoplastic polyurethane (TPU), which had a production of 21,900 tonnes in 2024 (2.4% share), is expected to capture 48.7% of the market by 2034.

The CBAS (coatings, binders, adhesives, and sealants) segment remains the most challenging, with just 1.4% share in 2024, but it is projected to rise to 30% share by 2034 at a CAGR of 41%, reflecting broader industrial adaptation to sustainable practices across polyurethane applications.

Regional Landscape

On a regional scale, EMEA currently leads with robust regulations, high public awareness, and advanced circular economy practices, including bio-based polyol production, a shift from fossil-based isocyanates, and structured chemical recycling and EPR schemes. APAC, although currently less mature, is rapidly advancing with major investments in green technologies, poised to outpace other regions due to its scale and innovation potential. In contrast, the Americas show a fragmented picture; while some sub-regions demonstrate progress in bio-based materials and waste systems, overall momentum is limited by inconsistent regulations and slower market-driven transitions. Without cohesive policy and industrial reforms, the Americas risk falling behind. In conclusion, EMEA sets the benchmark, APAC shows the highest growth potential, and the Americas face stagnation unless substantial sustainability initiatives are adopted.

The report is available at a price of €14,500. Please contact us for further information.

For more information, please contact ial@brggroup.com

IAL Consultants (A Division of BRG Enterprise Solutions Ltd)

CP House, 97-107 Uxbridge Road, Ealing, London W5 5TL

Tel: +44 (0) 20 8832 7780

Comments